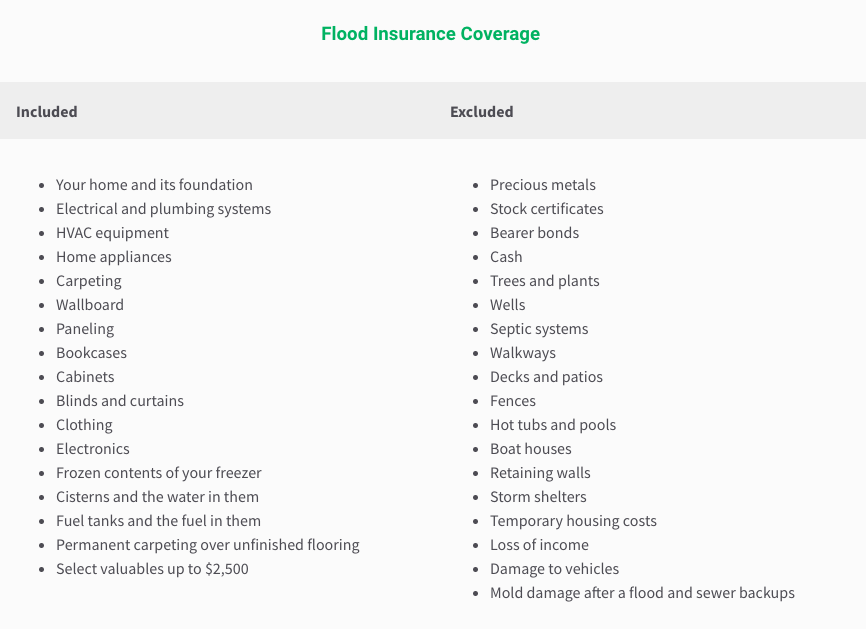

Weber went on to explain this is the first major change to how flood insurance rates are calculated since the 1970s. Homeowners insurance may cover fire and wind damage, but virtually never covers damage from flooding natures most common natural disaster. government backs NFIP policies through the treasury, and rates are set by the program. The figures in the table below are for flood insurance policies through the NFIP. The City provides a map information service enabling all residents to determine the flood zone of a specific property. One result of this change, because it is more individual to your specific property, means that if you have a less expensive home, you are no longer going to be subsidizing the flood insurance of people who live in more expensive homes, all other things being equal," explained Weber. According to the Federal Emergency Management Agency (FEMA), the average annual flood insurance policy premium in 2019 was 700. We saw the average annual cost of flood insurance range from 443 a year in Maryland to 1,315 per year in Vermont, with a nationwide average of 851 per year. Keep your TX home and property protected from flood.

If your individual property's risk is higher or lower, that will be reflected in your rates. Most flood insurance policies are underwritten through FEMA’S National Flood Insurance Program, but you may be able to purchase private flood insurance instead. Get Texas flood insurance quotes, cost & coverage fast with the National Flood Insurance Program (NFIP). Under the new method, it's a lot more individual.

"Previously, rates are basically set just on whether or not you are in the mapped flood plain. Flood insurance costs an average of 859 a year from the National Flood Insurance Program (NFIP), according to a Forbes Advisor analysis of flood insurance rates. Many people strat away from flood insurance as they dont deem it necessary. FEMA estimates that 86% of policies in Texas will see some sort of increase.įEMA said the new policy will be a more equitable way of calculating rates based on the risk of the policy holder's property.Īnna Weber, a senior policy analyst with the Natural Resources Defense Council, explains how rates will be calculated under the new policy. Under the new policy, Risk Rating 2.0, many Texans will soon see a monthly increase in their flood insurance rate. HOUSTON, Texas (KTRK) - Phase 1 of FEMA's new policy on the way flood insurance is priced begins on Oct. Because of the change, you could see an increase in rates. The exact cost of flood insurance in Texas, however, will vary from. FEMA's new policy on the way flood insurance is priced begins in October. The typical range for flood insurance rates in Texas is between 474 to 1,444 per year, with the average cost at about 661.

0 kommentar(er)

0 kommentar(er)